Tax Benefits for Child Daycare Providers and Users – Henssler Financial

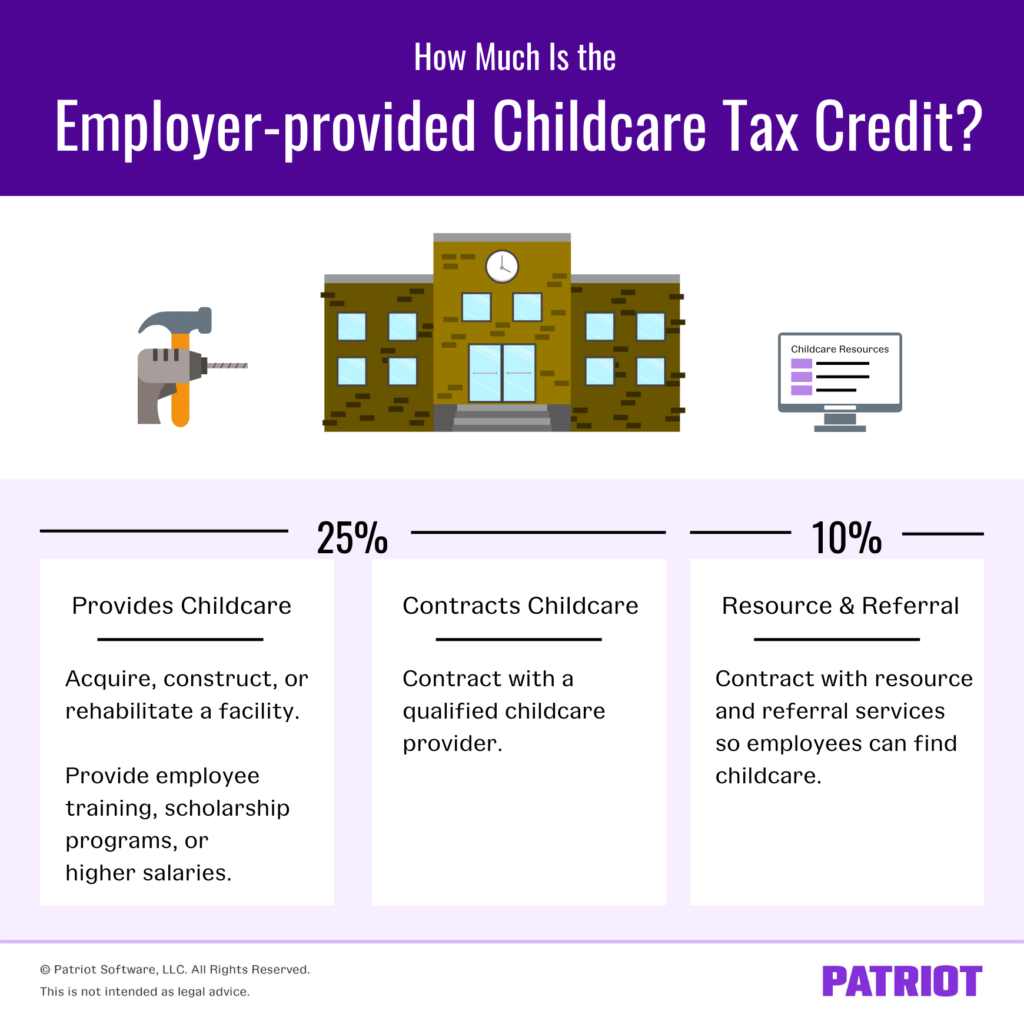

Special tax benefits are available for those providing daycare services for children and the parents who pay for those services. We take a look at the various tax deductions daycare providers may use and the childcare tax credit that the parents may claim.

Form 1098: Childcare Expenses and Tax Breaks for Parents

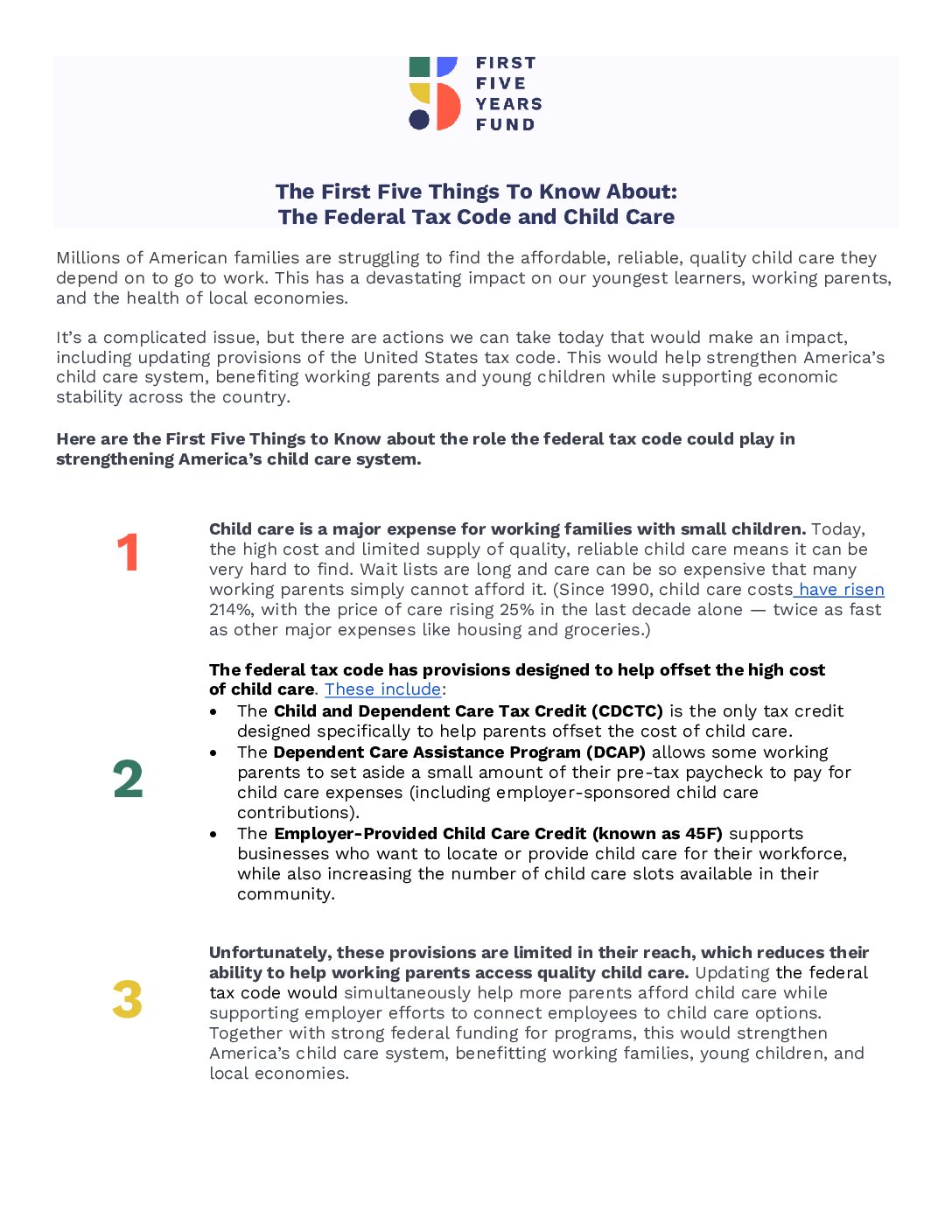

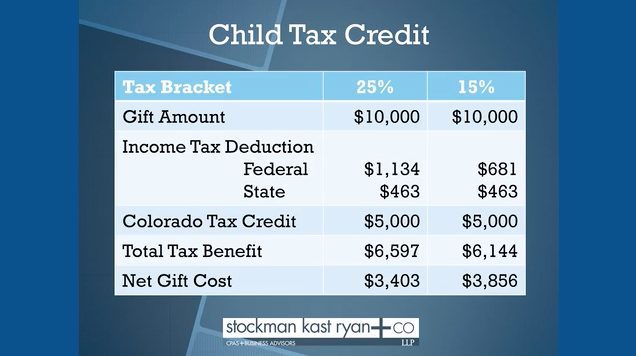

The First 5 Things To Know: The Federal Tax Code and Child Care

Child Care Tax Savings 2021 - Curious and Calculated

America's Best-kept Secret: The Employer-provided Childcare Tax Credit

Dependent Care Flexible Spending Accounts – Flex Made Easy

Donate - Hope & Home - Foster Care Colorado Springs

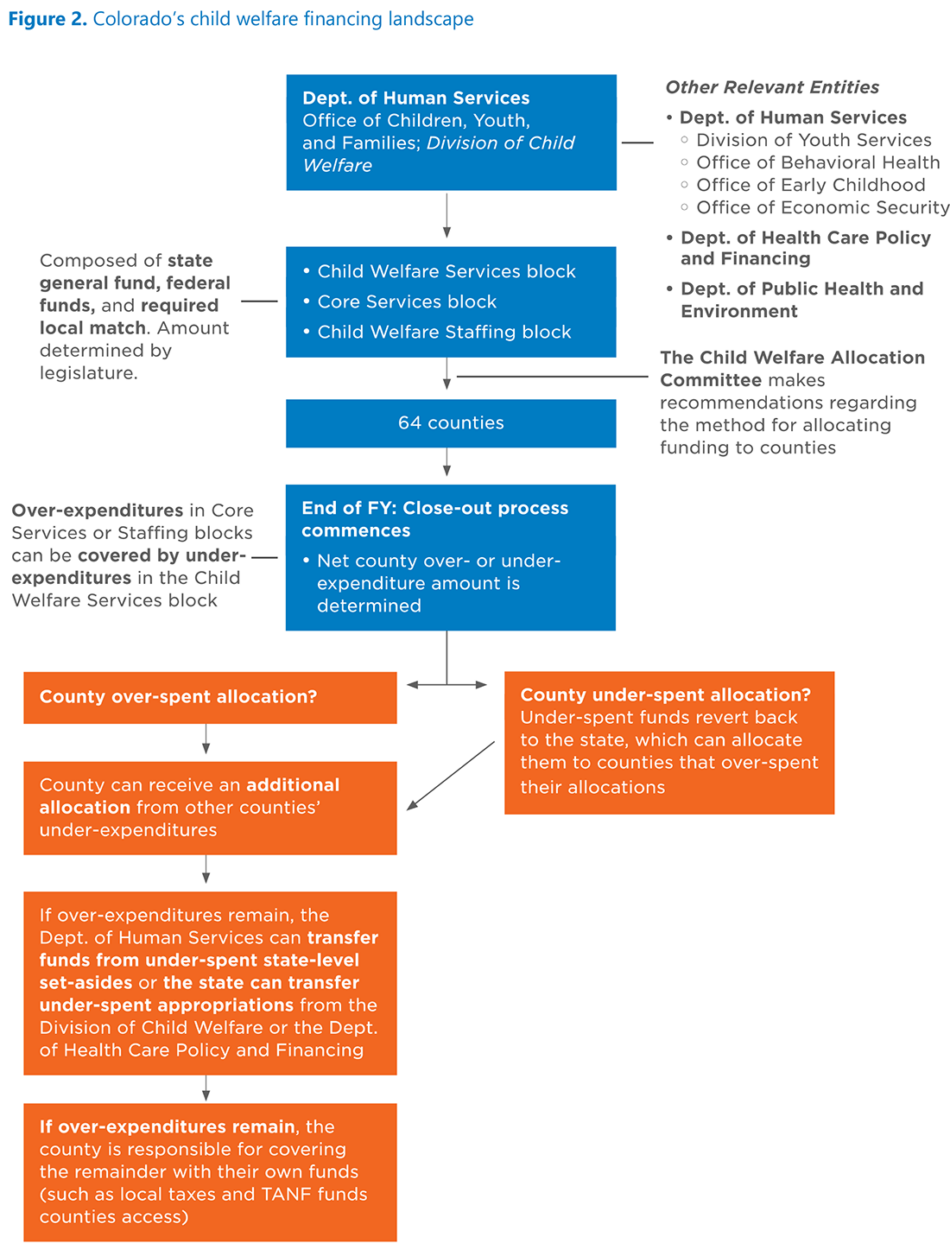

Child Welfare Financing in Colorado: Current Landscape and

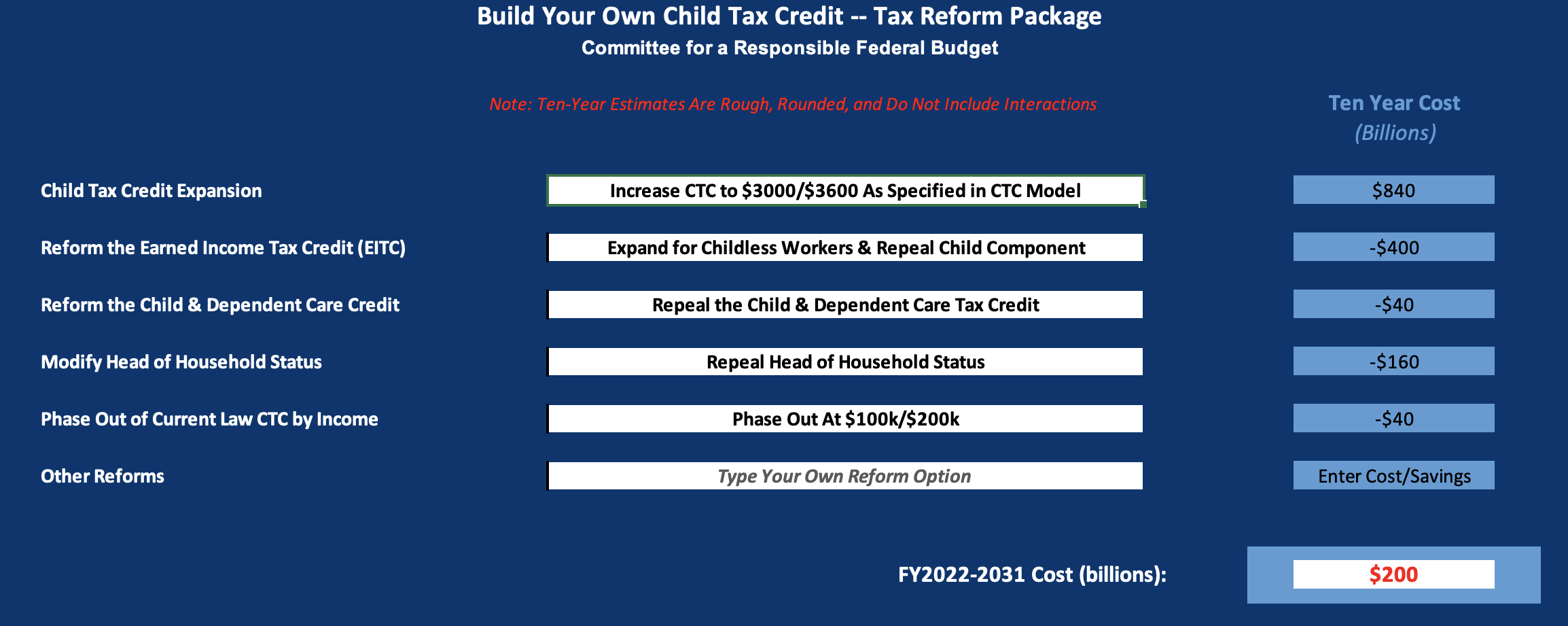

Build Your Own Child Tax Credit 2.0

Tax Benefits for Child Daycare Providers and Users – Henssler Financial

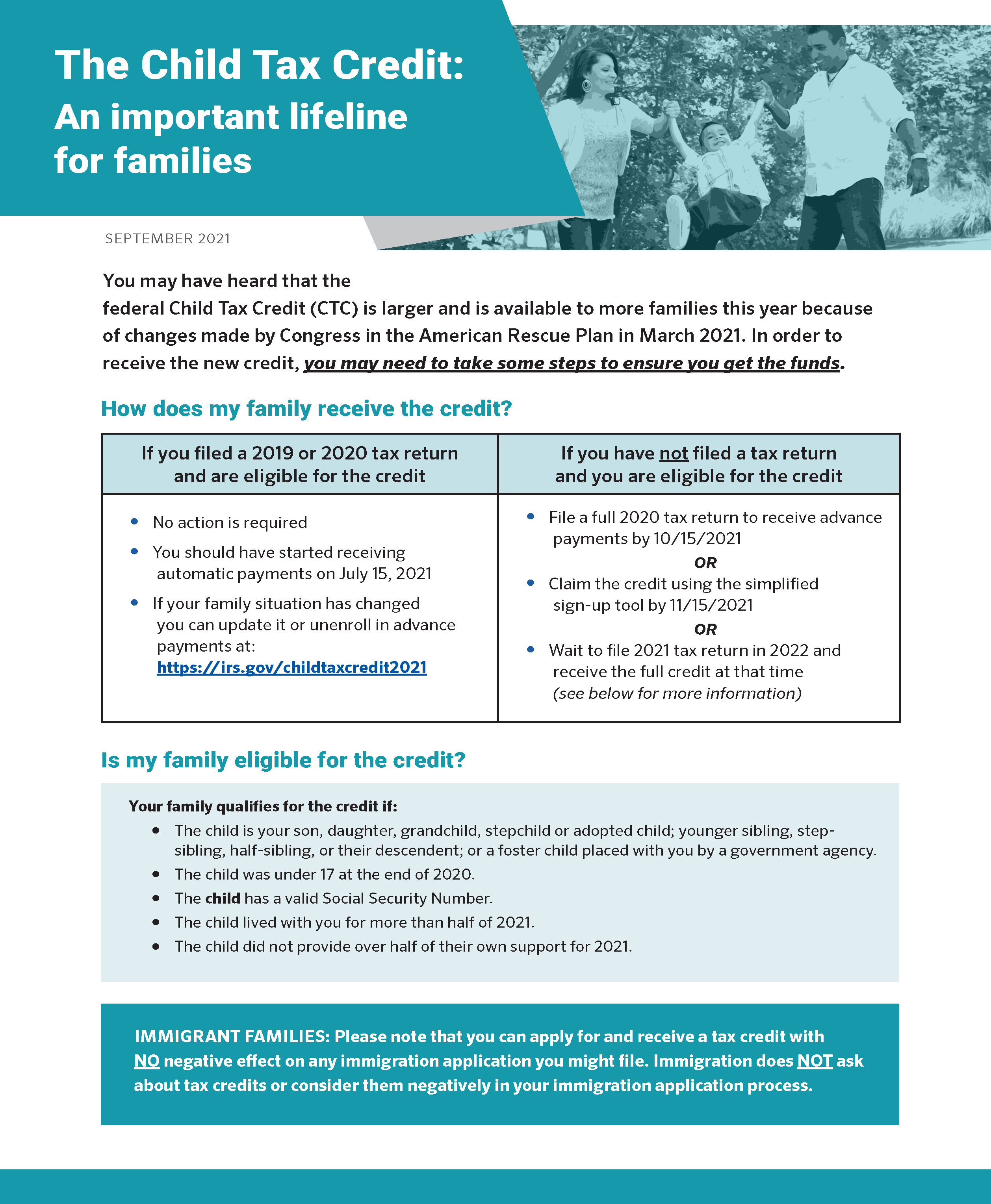

CHILDCTC - The Child Tax Credit

Tax Benefits for Child Daycare Providers and Users

T22-0242 - Tax Benefit of the Child Tax Credit (CTC), Baseline

Tax Benefits for Child Daycare Providers and Users

The Child Tax Credit: An important lifeline for families – North

Phoenix Disabled Adult Child (DAC) Benefits